2-3: What is a company worth?

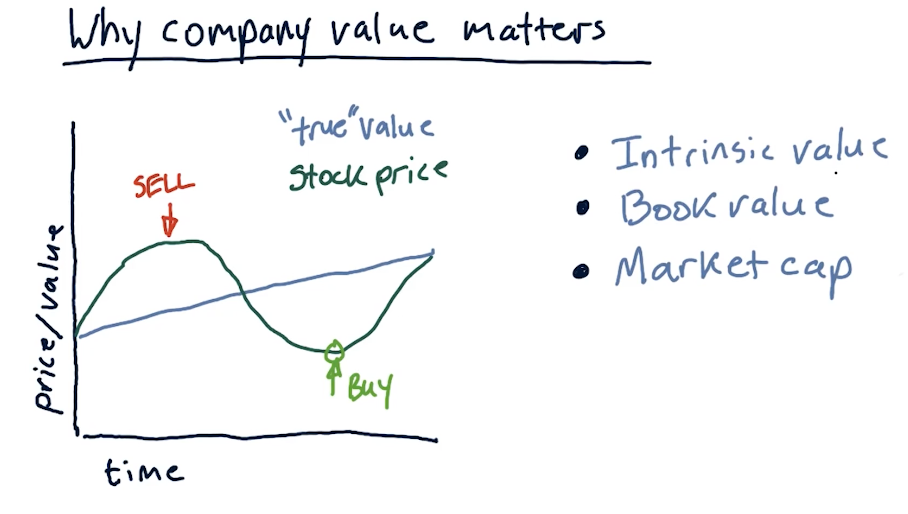

Why company value matters

A company has a true value and a stock price. The true value is not always readily apparent, and the stock value goes high or low over time, depending on trends in the market. Like always, when a stock is overvalued we want to sell and when a stock is undervalued, we want to buy.

- Intrinsic value - the value of a company as estimated by future dividends

- Book value - assets that the company owns

- Market cap - value of the stock on the market

Below is a high-level overview from the lecture of the concepts above:

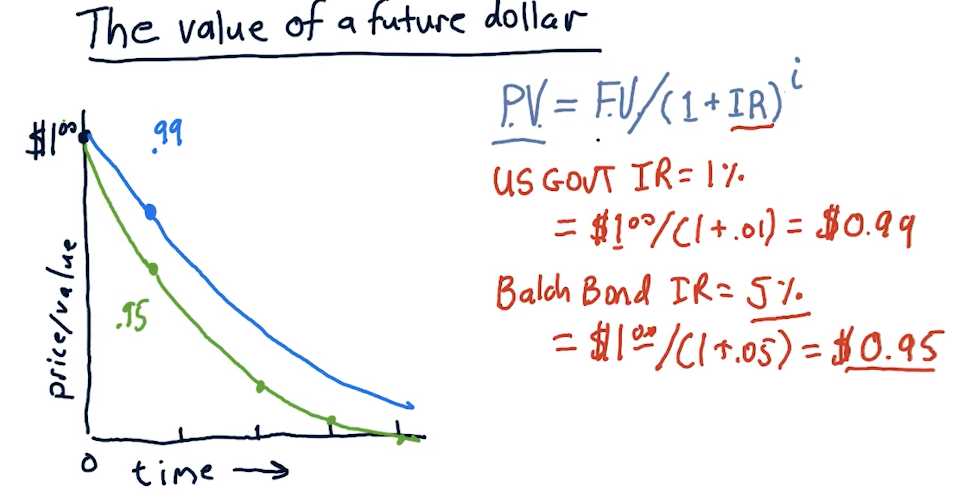

The value of a future dollar

This section of the lecture discusses the value of a future dollar - how we can calculate how much a dollar will be worth given a particular interest rate on a bond.

The equation is as follows:

price_value = future_value / (1 + interest_rate)**years

Obviously, a dollar now is worth more than a dollar in the future. The high-level representation below displays how to calculate price value against future value given an interest rate.

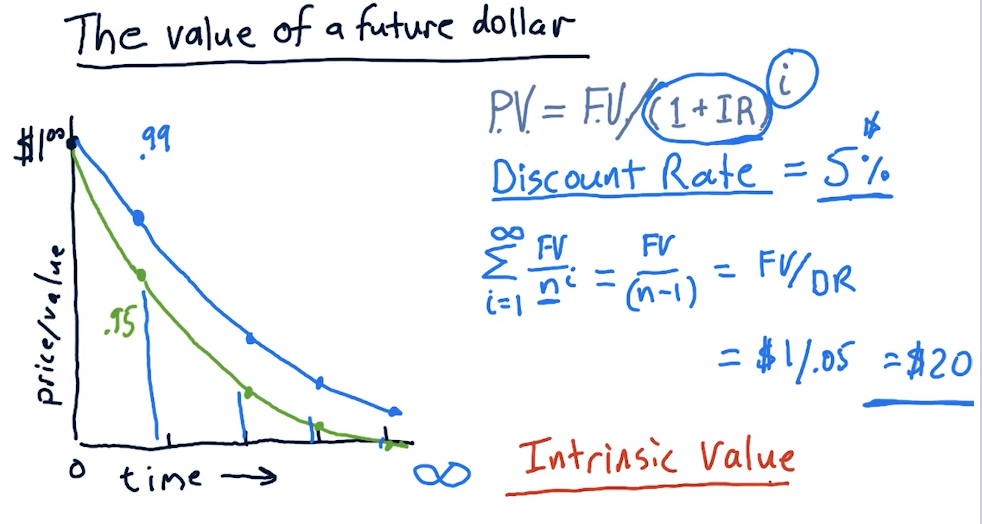

Intrinsic value

The lecture provides a breakdown on how to calculate intrinsic value, given a particular interest rate or discount rate. The equation is essentially as follows:

intrinsic_value = future_value / discount_rate

Market capitalization

Market capitalization or market cap is simple:

market_cap = num_shares * share_price