2-1: So you want to be a hedge fund manager?

This lesson covers the fundamentals of being a portfolio manager.

Types of funds

The following are types of funds:

- ETFs - exchange traded funds

- Buy and sell like stocks

- Represent baskets of stocks

- Transparent

- Mutual funds

- Buy and sell at the end of the trading day

- Quarterly disclosure

- Less transparent

- Hedge funds

- Buy and sell by agreement

- No disclosure

- Not transparent

Incentives: How are they compensated?

- ETFs - Managers of ETFs are compensated according to an expense ratio, related to AUM.

- Mutual funds - Compensated according to an expense ratio, usually much higher than ETFs.

- Hedge funds - Follow an old model called two and twenty.

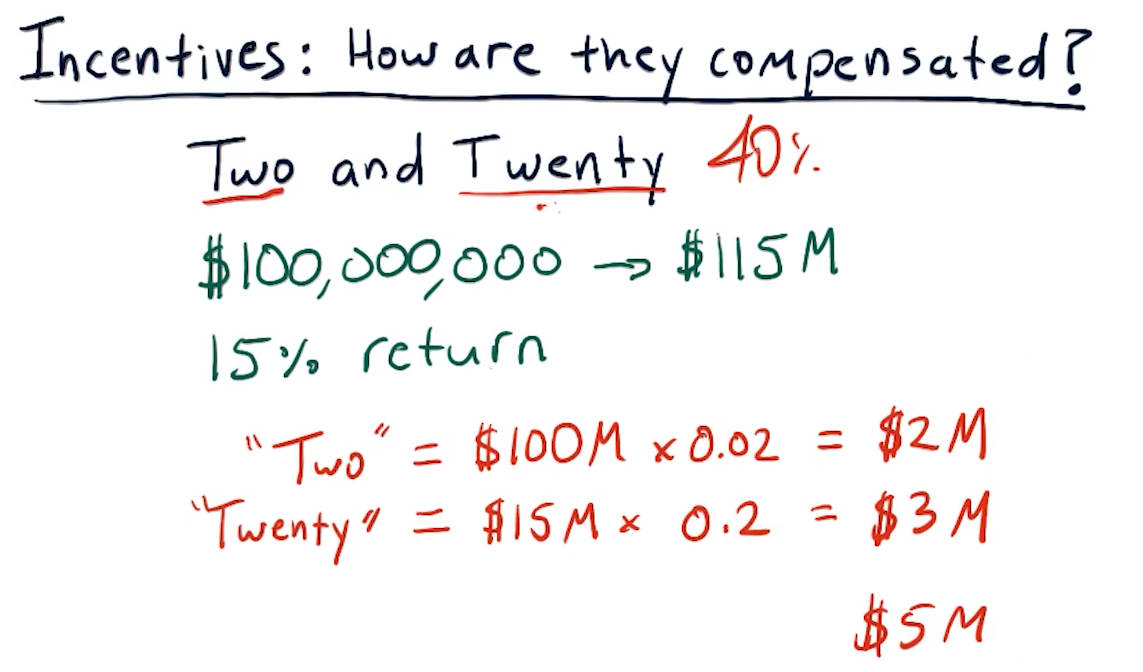

Two and twenty

Below is a breakdown from the lectures on how the two and twenty compensation model works for hedge fund managers:

How do hedge funds attract investors?

Hedge funds are usually designed to attract and do business with the following entities:

- Individuals - usually particularly wealthy individuals because hedge funds are on average only made up of 100 people

- Institutions - institutions like Harvard or Georgia Tech that want to park assets and watch them accrue in value

- Funds of funds

Why would one of these entities pick a particular hedge fund over another?:

- Track record - potential investors will always review the track record of a particular fund. The fund should have no less than 5 years of maturity.

- Simulation and story - potential investors would like to see the backtesting results of a particular strategy, and a story as to why the hedge fund manager believes their strategy is novel or successful.

- Good portfolio fit - potential investors will be on the lookout to find a portfolio they don't already have. It's like investors will not invest into a hedge fund that already covers a sector of the market they have assets in.

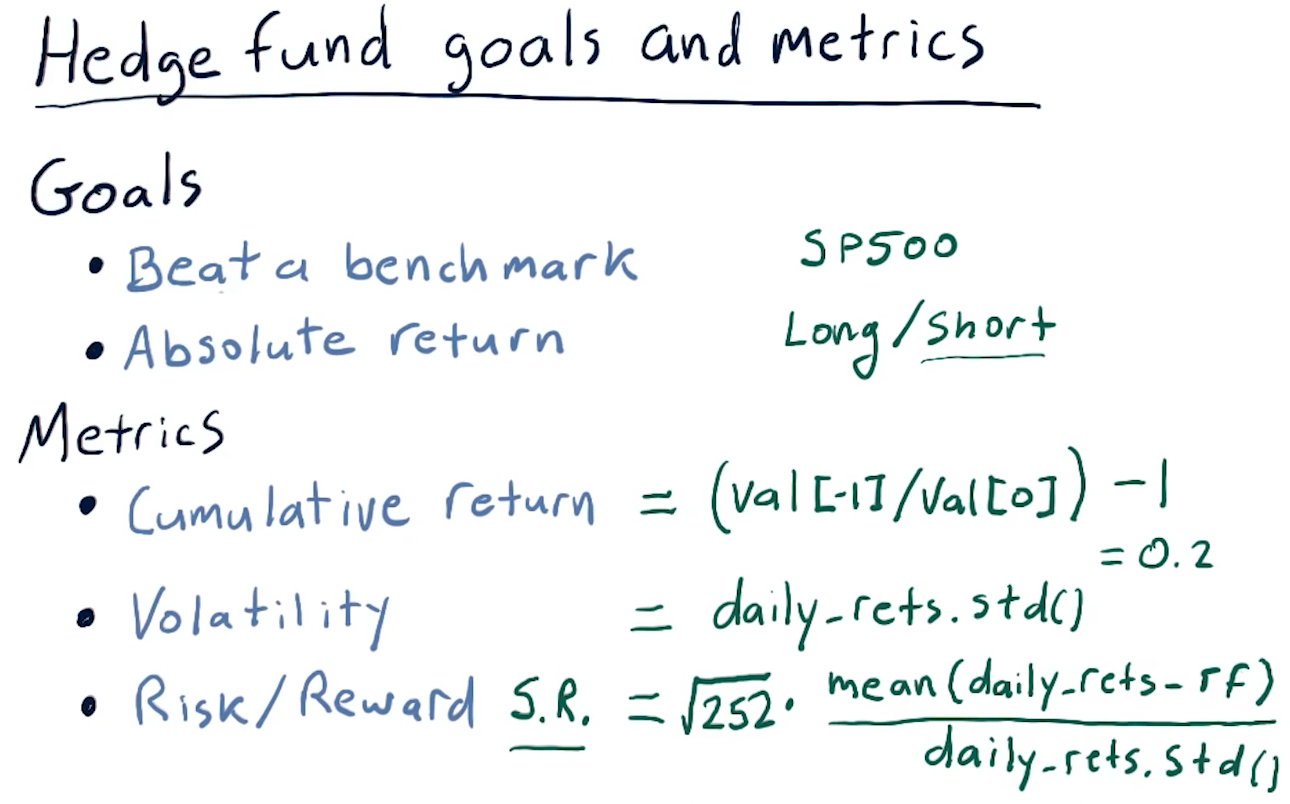

Hedge fund goals and metrics

Hedge funds usually have one of the two following goals:

- Beat a benchmark - following or beating a benchmark like the SP500

- Riskier because it usually follows the market and its trends.

- Absolute return - playing long and short positions so that, at the

end of the year, the fund is positive.

- Usually doesn't have large returns, but a safe bet to always have positive returns.

We calculate the metrics like we've done in other lessons. You can find the lecture slide for this section of the lesson, below:

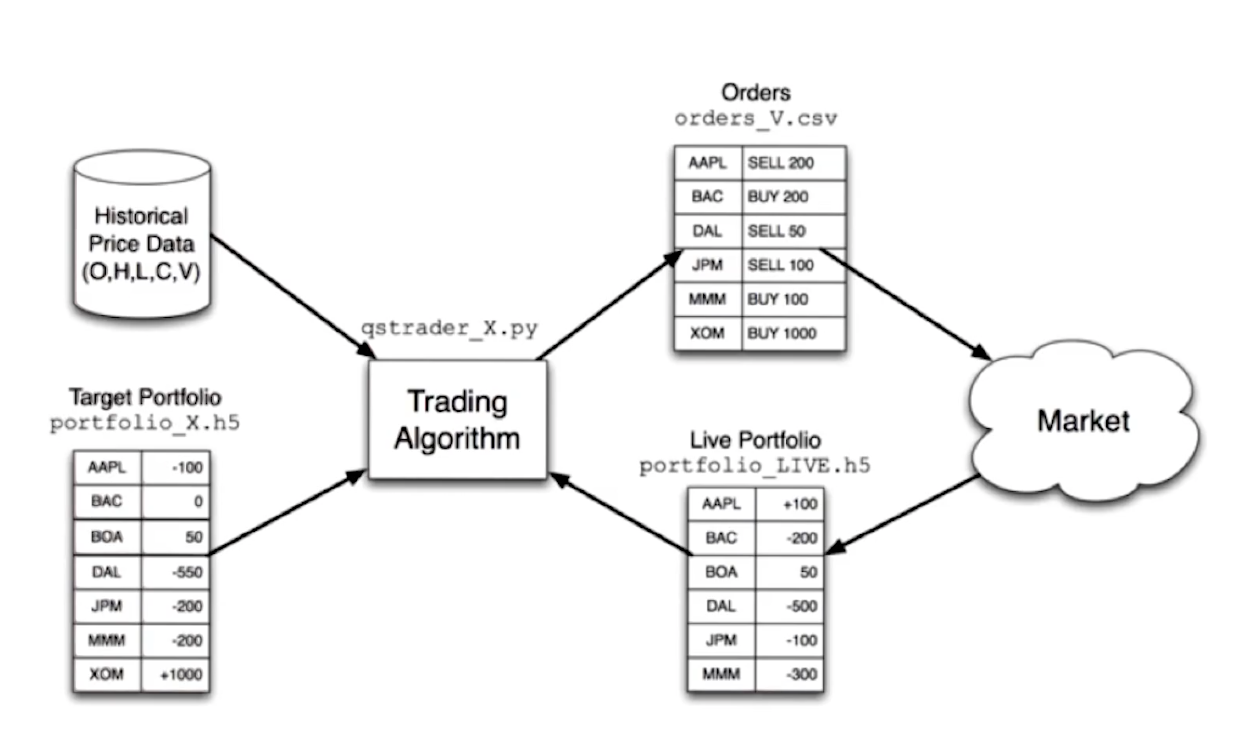

The computing inside a hedge fund

The lecture provides us with a high-level overview of computing within a hedge fund, this can be found below. One thing to note with this image is that, if the hedge fund wanted to enter a particular position, e.g. purchase 1 mil worth of AAPL stock, the trading algorithm isn't going to create a BUY signal to conduct this immediately. The trading algorithm leverages feedback from the market and executes orders incrementally to avoid influencing the market too much while allowing the fund to enter a particular position.

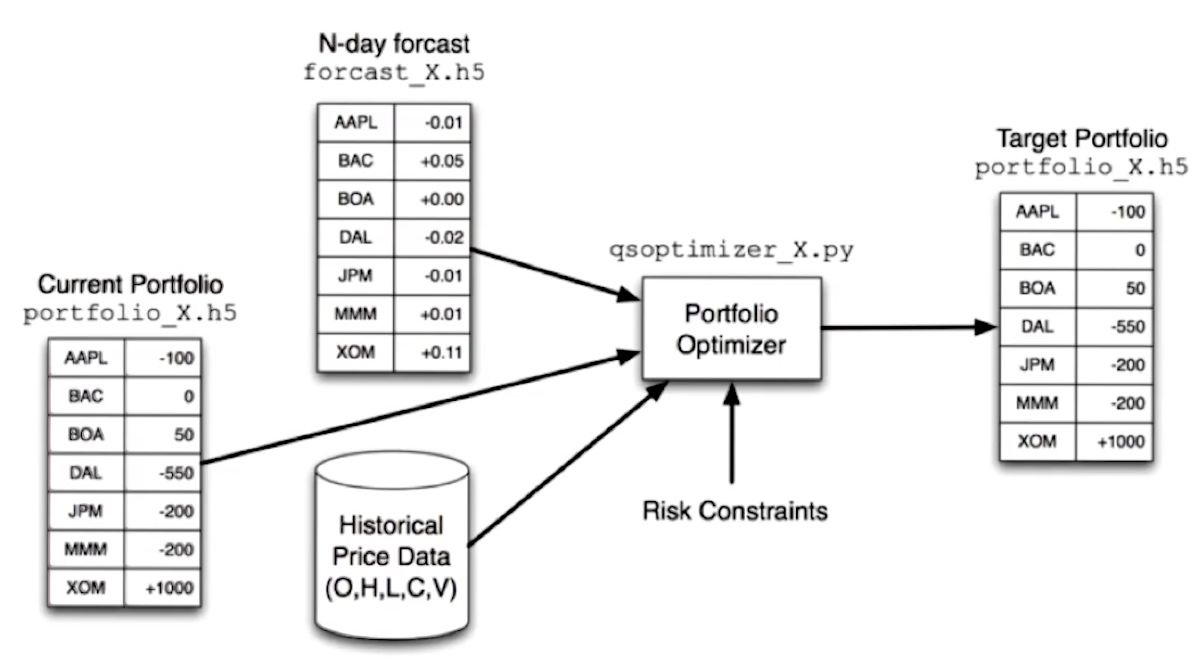

Up next, the lecture provides us with how target portfolios are calculated. This is typically done using an optimizer like we've seen in previous lessons. The optimizer leverages inputs from a forecaster, the current portfolio, historical price data, and some risk constraints provided by the hedge fund manager. A high-level overview of this concept is provided below:

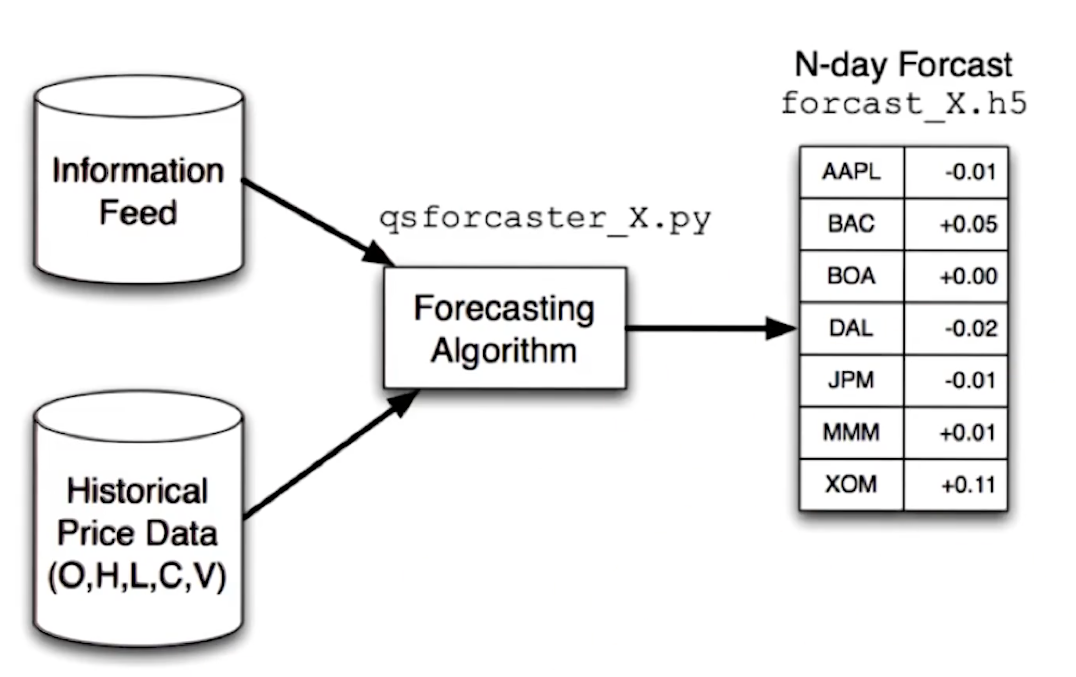

Finally, the lecture provides us with a high level overview of how the forecaster is creating the forecast leveraged by the optimizer. Again, historical data feeds into this, as well as some proprietary information feed being leveraged by the hedge fund.

Definitions

- liquid - the ease at which one can buy or sell shares within a particular holding, e.g. Stocks, ETFs. These usually have a high volume of trading.

- large cap - represented by number of shares * price of each share

- assets under management (AUM) - buzz word, how much money is being managed by the fund?

- two and twenty - 2 percent of AUM and 20 percent of the profits.